Keller Group plc ('Keller' or 'the Group'), the world's largest geotechnical specialist contractor, announces its results for the year ended 31 December 2023.

Record results provide a new foundation for long term growth

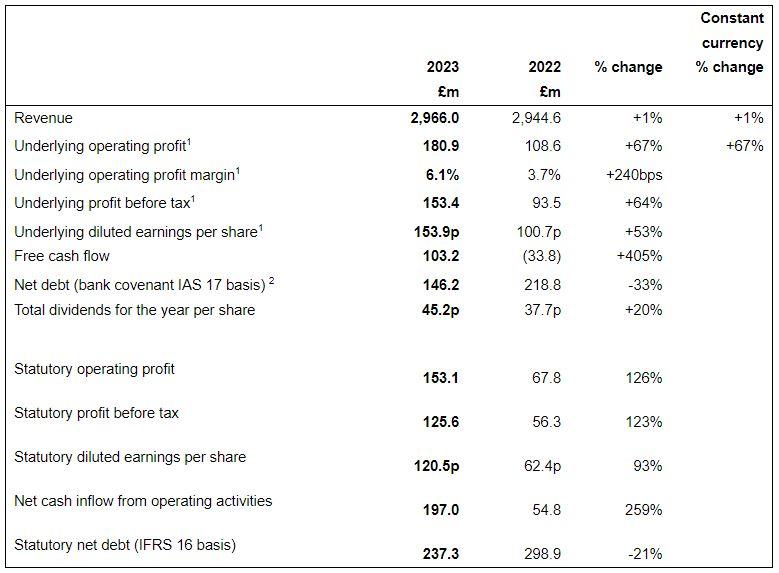

1Underlying operating profit, underlying profit before tax and underlying diluted earnings per share are non-statutory measures which provide readers of this announcement with a balanced and comparable view of the Group's performance by excluding the impact of non-underlying items, as disclosed in note 9 of the consolidated financial statements

2Net debt is presented on a lender covenant basis excluding the impact of IFRS 16 as disclosed within the adjusted performance measures in the consolidated financial statements

Highlights

- Record performance with significant progress made in key measures of financial performance:-

- Revenue of £2,966.0m, similar to prior year

- Underlying operating profit c.80% higher than the five year average

- Underlying operating profit margin over 6% for the first time in eight years

- Underlying ROCE at 22.8% (2022: 14.9%), the highest for 15 years

- Free cash generation of over £100m, accelerating leverage reduction to the bottom of the target range

- Underlying operating profit increased to £180.9m, up 67% (at constant currency) and underlying operating profit margin increased to 6.1% (2022: 3.7%); largely driven by an improved foundations performance and resilient Suncoast pricing in the NA business, together with a strong performance at Keller Australia, partly offset by a disappointing performance in Europe

- Underlying EPS of 153.9p, up 53%, driven by higher operating profit partially offset by increased finance costs and a higher effective tax rate

- Statutory operating profit up 126% to £153.1m

- Statutory diluted EPS of 120.5p, up 93%

- Strong recovery in free cash flow, with an inflow of £103.2m (2022: £33.8m outflow), driven by improved profitability

- Net debt2 reduced by 33% to £146.2m (2022: £218.8m), equating to net debt/EBITDA leverage ratio of 0.6x (2022:1.2x), towards the lower end of the Group's 0.5x-1.5x target range

- Robust year-end order book of £1.5bn

- Safety: accident frequency rate (AFR) was flat year on year; small increase in injuries in AMEA offset by an improvement in Europe

- Further successful execution of strategy with continued portfolio rationalisation including the strategic decision to exit from Cyntech Tanks, Egypt, Sub-Saharan Africa and Kazakhstan

- In recognition of the excellent performance in the year and the Group's future prospects, the Board is recommending a rebasing of the dividend by increasing the total dividend for 2023 by 20%

The strong momentum of the business is encouraging and whilst inevitably there will be fluctuations across the Group, our diverse revenues and improved operational delivery underpin our expectation that 2024 will be another year of underlying progress.

The significant improvement in business performance and continued disciplined execution of our strategy, will provide both resilience in the short term and drive growth in the long term, through both organic and targeted M&A opportunities. Accordingly, we view the Group's prospects with increased confidence."

Preliminary Results announcement for year ended 31 December 2023

For further information, please contact:

Keller Group plc

Michael Speakman, Chief Executive Officer

David Burke, Chief Financial Officer

Caroline Crampton, Group Head of Investor Relations

www.keller.com

020 7616 7575

FTI Consulting

Nick Hasell

Matthew O’Keeffe

020 3727 1340

A webcast for investors and analysts will be held at 09.00 GMT on 7 March 2023 and will also be available later the same day on demand

www.investis-live.com/keller/65c36af3d0d5201200a20f51/drwe

Conference call:

Participants joining by telephone:

UK (Toll-Free): 0800 358 1035

UK(Local): +44 (0)20 3936 2999

All other locations: +44 20 3936 2999

Participant access code: 966988

Accessing the telephone replay:

A replay will be available until 12 March 2024

UK (Toll-Free): 0800 304 5227

UK: +44 (0)20 3936 3001

Access code: 685714