Keller Group plc (“Keller” or “the Group”), the international ground engineering specialist, is pleased to announce its full-year results for the year ended 31 December 2012.

Highlights include:

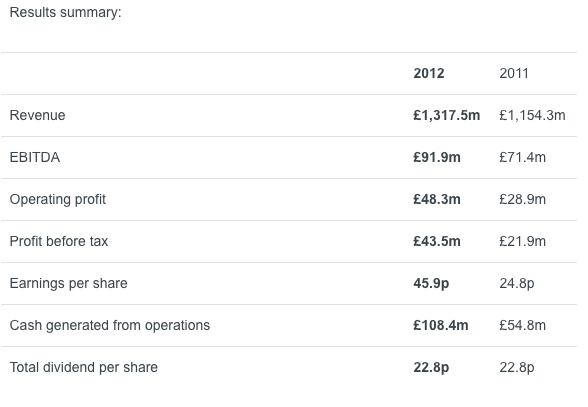

- Record revenue of £1,317.5m (2011: £1,154.3m), up 14%

- Profit before tax doubled to £43.5m (2011: £21.9m)

- Business improvement initiatives yielding good results

- Earnings per share of 45.9p (2011: 24.8p)

- Strong cash generation reduces year-end net debt to £51.2m (2011: £102.5m), representing 0.6x EBITDA (2011: 1.4x)

- Total dividend maintained at 22.8p, with dividend cover of 2.0x (2011: 1.1x)

Justin Atkinson, Keller Chief Executive said:

“These results reflect an improved performance in three of our four divisions, driven by a combination of the self-help measures taken across the Group and a strong performance by our business in North America, where market conditions continue to improve. Whilst our EMEA division faced very challenging markets across most of Europe, resulting in a first-half loss, its performance improved as the year progressed and it made a profit for the year as a whole.

“Overall, we are confident that 2013 will be another year of progress and that the measures we have taken, and continue to take, will further improve and develop our business.”

A presentation for analysts will be held at 9.30am at The London Stock Exchange,

10 Paternoster Square, London, EC4M 7LS

A live audio webcast will be available from 9.30 am and, on demand, from 2.00 pm at

http://www.keller.co.uk/investors/results-centre/latest-results

Print resolution images are available for the media to download from www.vismedia.co.uk

Notes to Editors:

Keller is the world’s largest independent ground engineering specialist, providing technically advanced and cost-effective foundation solutions to the construction industry. With annual revenue of £1.3bn, Keller has approximately 7,000 staff world-wide.

Keller is the clear market leader in the US and Australia; it has prime positions in most established European markets; and a strong profile in many developing markets.