Keller Group plc (‘Keller’ or the ‘Group’), the world’s largest geotechnical specialist contractor, announces its results for the half year ended 30 June 2025.

Good H1 performance ahead of expectations; FY growth outlook maintained

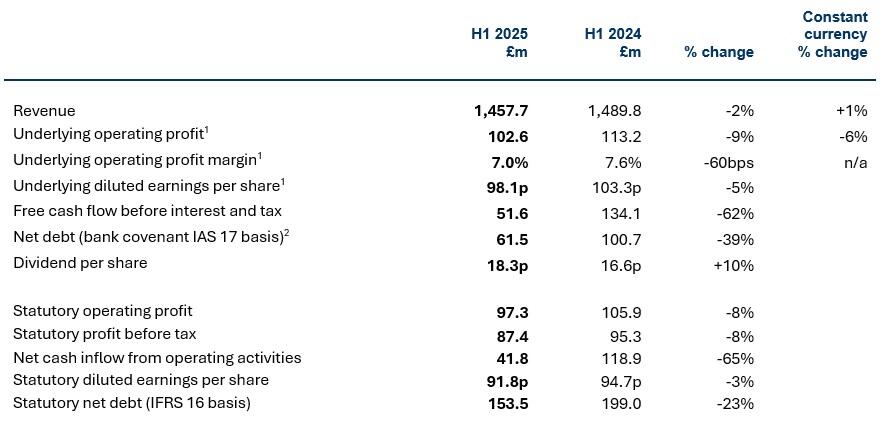

1 Underlying operating profit and underlying diluted earnings per share are non-statutory measures which provide readers of this Announcement with a balanced and comparable view of the Group’s performance by excluding the impact of non-underlying items, as disclosed in note 7 to the interim condensed consolidated financial statements.

2 Net debt is presented on a lender covenant basis excluding the impact of IFRS 16 as disclosed within the adjusted performance measures in the interim condensed consolidated financial statements.

Highlights

- A good first half performance ahead of market expectations3, evidencing the sustained improvement in business performance.

- Performance relative to the strong prior year period reflected the expected normalisation of market conditions in North America, particularly pricing at Suncoast, alongside profitable growth in the Europe and Middle East (EME) and Asia-Pacific (APAC) Divisions.

- Underlying operating margin remains strong at 7% (historic five-year H1 average: 4.8%).

- Net debt2 of £61.5m, up £32m since Dec 2024; driven by £25m share buyback and increased working capital investment. Net debt/EBITDA leverage ratio2 of 0.2x (H1 2024: 0.3x; FY 2024: 0.1x).

- Successful completion of an initial £25m tranche of the multi-year share buyback programme in H1. Keller announces its intention to launch an additional tranche of £25m in H2.

- Underlying ROCE at 26.7% (H1 2024: 28.4%).

- Strong order book sustained at previous record level of £1.6bn.

- Accident Frequency Rate reduced to 0.04 with five lost time injuries (H1 2024: 0.08; eight lost time injuries).

- The Board declares an interim dividend of 18.3p, with the intention of applying a 5% increase in total for 2025.

- The Board’s expectations for full year 2025 maintained, despite the anticipated FX headwind, underpinned by the strong order book.

- James Wroath joins as Chief Executive Officer on 18 August 2025.

David Burke, Chief Financial Officer, said:

"We have delivered a good first half performance against a strong comparative period, with underlying business performance remaining robust. Our strong balance sheet provides us with flexibility, enabling organic growth as well as targeted M&A, along with further financial returns to shareholders with an increase to the interim dividend and an intention to launch an additional £25m share buyback in the second half. Whilst the geopolitical and macroeconomic volatility continues to create market uncertainty, the Group’s improved operational capabilities, strong order book and healthy tendering pipeline give the Board confidence in meeting expectations for full year 20254, despite an anticipated increasing FX headwind in the second half."

3 Company compiled consensus underlying operating profit for H1: £97.4m.

4 Analyst consensus underlying operating profit for FY 2025: £215m.

For further information, please contact:

Keller Group plc

David Burke, Chief Financial Officer

Caroline Crampton, Group Head of Investor Relations

www.keller.com

020 7616 7575

FTI Consulting

Nick Hasell

Matthew O’Keeffe

020 37271340

A webcast and presentation for investors and analysts will be held at 09.00am BST on 5 August 2025, at:

FTI Consulting

200 Aldersgate Street

London EC1A 4HD

RSVP: [email protected]

The webcast replay will be available later the same day on demand:

https://connectstudio-portal.world-television.com/en/687a7ea431be6b1c6956e5d1

Conference call:

Operator Assisted Dial-In:

United Kingdom (Local): +44 20 3481 4247

United Kingdom (Toll-Free): +44 800 260 6466

United States – New York: (646) 307-1963

Conference ID: 4755308

Notes to editors:

Keller is the world's largest geotechnical specialist contractor providing a wide portfolio of advanced foundation and ground improvement techniques used across the entire construction sector. With around 10,000 staff and operations across five continents, Keller tackles an unrivalled 5,500 projects every year, generating annual revenue of c.£3bn.

Cautionary statements:

This document contains certain 'forward-looking statements' with respect to Keller's financial condition, results of operations and business and certain of Keller's plans and objectives with respect to these items. Forward-looking statements are sometimes, but not always, identified by their use of a date in the future or such words as 'anticipates', 'aims', 'due', 'could', 'may', 'should', 'expects', 'believes', 'intends', 'plans', 'potential', 'reasonably possible', 'targets', 'goal' or 'estimates'. By their very nature, forward-looking statements are inherently unpredictable, speculative and involve risk and uncertainty because they relate to events and depend on circumstances that may or will occur in the future. There are a number of factors that could cause actual results and developments to differ materially from those expressed or implied by these forward-looking statements. These factors include, but are not limited to, changes in the economies and markets in which the Group operates; changes in the regulatory and competition frameworks in which the Group operates; the impact of legal or other proceedings against or which affect the Group; and changes in interest and exchange rates. For a more detailed description of these risks, uncertainties and other factors, please see the principal risks and uncertainties section of the strategic report in the Annual Report and Accounts. All written or verbal forward-looking statements, made in this document or made subsequently, which are attributable to Keller or any other member of the Group, or persons acting on their behalf, are expressly qualified in their entirety by the factors referred to above. The forward-looking statements reflect knowledge and information available at the date of preparation of this announcement and Keller undertakes no obligation to update these forward-looking statements. Nothing in this document should be regarded as a profits forecast. This document is not an offer to sell, exchange or transfer any securities of Keller Group plc or any of its subsidiaries and is not soliciting an offer to purchase, exchange or transfer such securities in any jurisdiction. Securities may not be offered, sold or transferred in the United States absent registration or an applicable exemption from the registration requirements of the US Securities Act of 1933 (as amended).

LEI number: 549300QO4MBL43UHSN10. Classification: 1.2 (Half yearly financial reports).