Keller Group plc (‘Keller’ or ‘the Group’), the world’s largest geotechnical specialist contractor, announces its results for the year ended 31 December 2020.

A strong performance ahead of market expectations

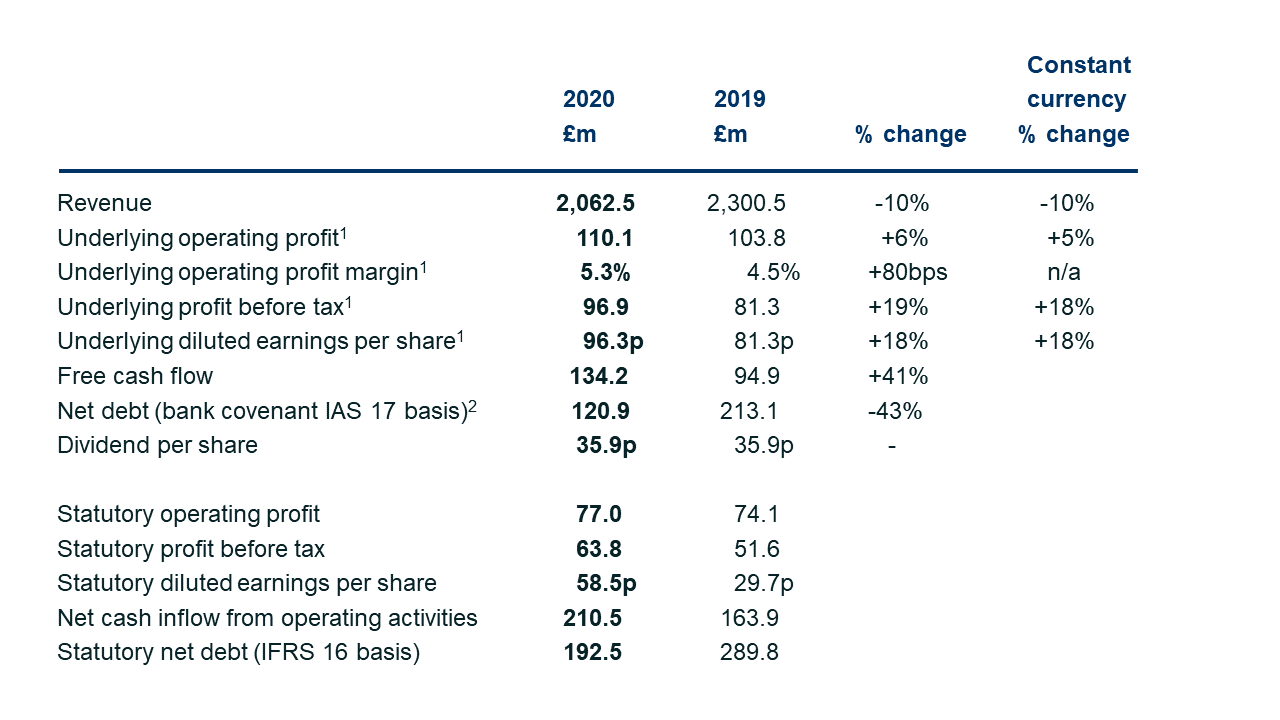

1 Underlying operating profit, profit before tax and underlying diluted earnings per share are non-statutory measures which provide readers of this announcement with a balanced and comparable view of the Group’s performance by excluding the impact of non-underlying items, as disclosed in note 8 of the consolidated financial statements

2 Net debt is presented on a lender covenant basis excluding the impact of IFRS 16 as disclosed within the adjusted performance measures in the consolidated financial statements

Highlights

- Underlying operating profit, cash generation and earnings per share all ahead of market expectations

- Revenue down 10% to £2,062.5m, driven by the impact of COVID-19 and the exit of non-core business activities

- Underlying operating profit of £110.1m, an increase of 6%, driven by a strong first quarter, a resilient second half, particularly in North America, and a full year of profitability in APAC. Underlying operating margin increased to 5.3% (2019: 4.5%)

- Strong cash performance with free cash flow up 41% to £134.2m (2019: £94.9m)

- Net debt (on a bank covenant IAS 17 basis) reduced by 43% to £120.9m, equating to net debt / EBITDA leverage ratio of 0.7x

- Good COVID-19 safety performance and further progress in operational safety evidenced by a 20% improvement in our overall accident frequency rate (AFR)

- Significant strategic progress made with the implementation of all the actions set out a year ago, despite the impact of COVID-19, transforming the Group into a more focused, higher-quality business

- Recommended final dividend of 23.3p, continuing the Group’s uninterrupted track record of increasing or maintaining dividends every year since flotation in 1994 and reflecting the financial strength of the Group

- Whilst our order book remains c£1bn, our expectations for a reduced trading performance in 2021 are unchanged given the previously indicated softening in the order intake, late cycle nature of our business and continuing macro uncertainty

Notwithstanding the strong momentum at the end of 2020, our expectations for a reduced trading performance in 2021 are unchanged. As previously indicated, we saw a softening in the order intake during the second half of 2020 and into 2021 with overall trading in the early part of the year relatively subdued. This, together with the late cycle nature of our business and the continuing uncertainty arising from the pandemic and macroeconomic outlook, means that we remain suitably cautious about the year ahead. We therefore anticipate 2021 to be a more challenging year than 2020, particularly in the first half which was especially strong last year.

Nonetheless, our leading market positions and the strategic actions we have taken to improve the Group’s performance, together with our financial resilience, will allow us to benefit from the longer-term structural growth drivers for global infrastructure and urbanisation in the years ahead. We therefore remain confident in our ability to deliver increasing shareholder returns through underlying profit growth and our progressive dividend policy.”

For further information, please contact:

Keller Group plc

Michael Speakman, Chief Executive Officer

David Burke, Chief Financial Officer

Caroline Crampton, Group Head of Investor Relations

www.keller.com

020 7616 7575

FTI Consulting

Nick Hasell

Matthew O’Keeffe

020 3727 1340

A webcast for investors and analysts will be held at 08.30 GMT on 9 March 2021 and will also be available later the same day on demand https://www.investis-live.com/keller/6022cdcddd22a11400bd3c30/mlsw